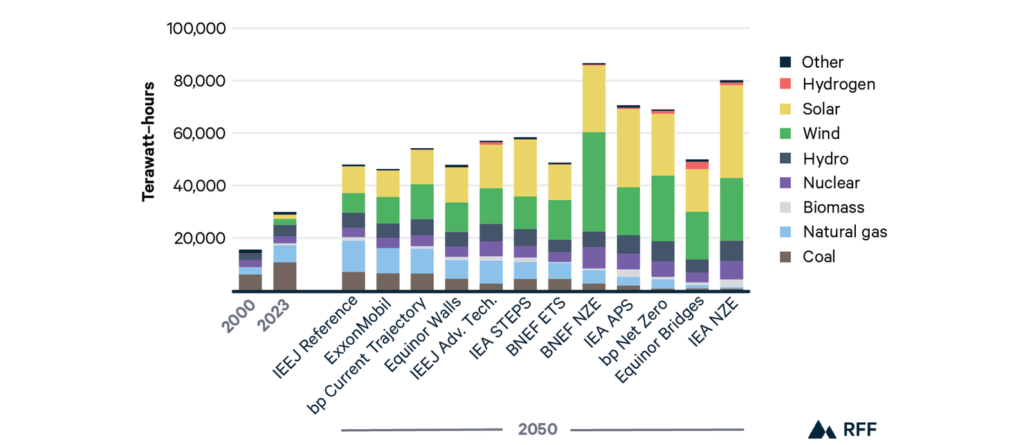

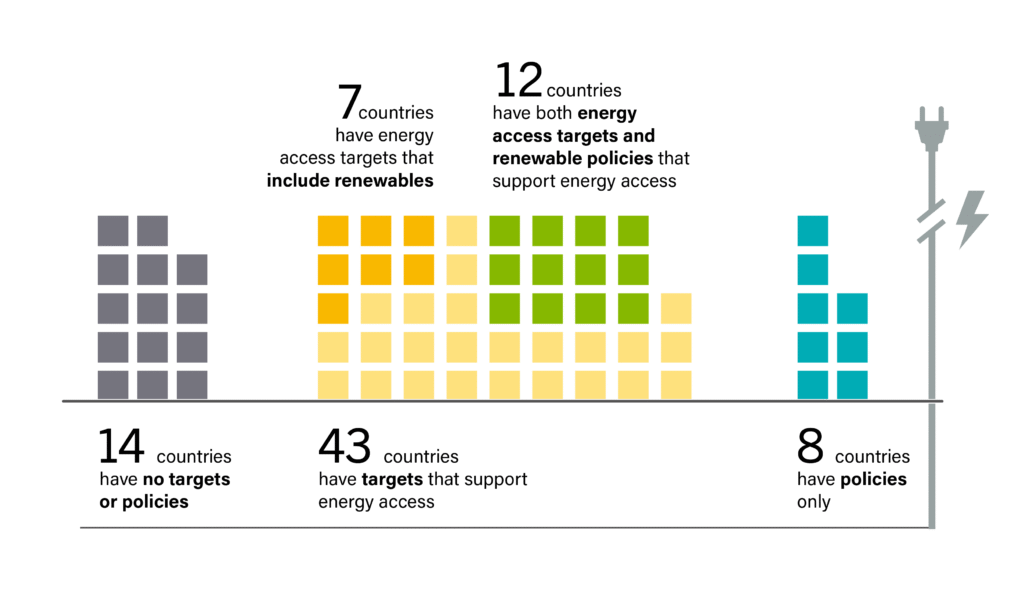

The Middle East, historically known for its oil wealth, is now positioning itself as a leader in clean energy innovation. National strategies like Saudi Vision 2030 and the UAE Net Zero by 2050 roadmap are driving massive investments in hydrogen, solar, desalination, and carbon capture projects.

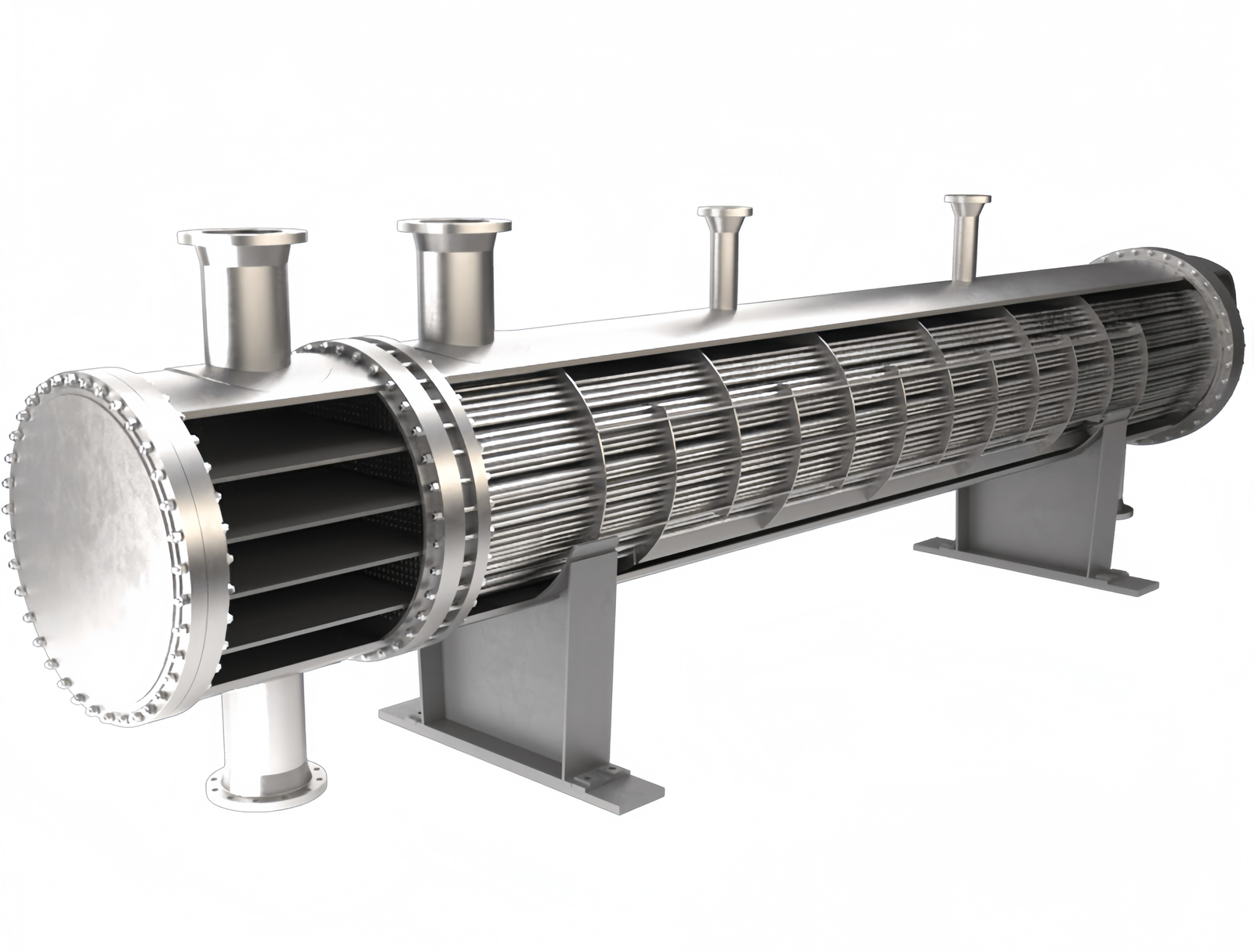

As a result, the region’s energy infrastructure is undergoing significant upgrades, creating a wave of new demand for high-performance stainless steel pipes, heat exchanger tubes, and ASME-certified components designed for harsh, corrosive, or hydrogen-rich environments.

1. Green Energy Projects Demand Specialized Tubing Solutions

In 2025 and beyond, Middle Eastern countries are commissioning large-scale green hydrogen plants, hybrid desalination systems, and LNG expansions. These projects require:

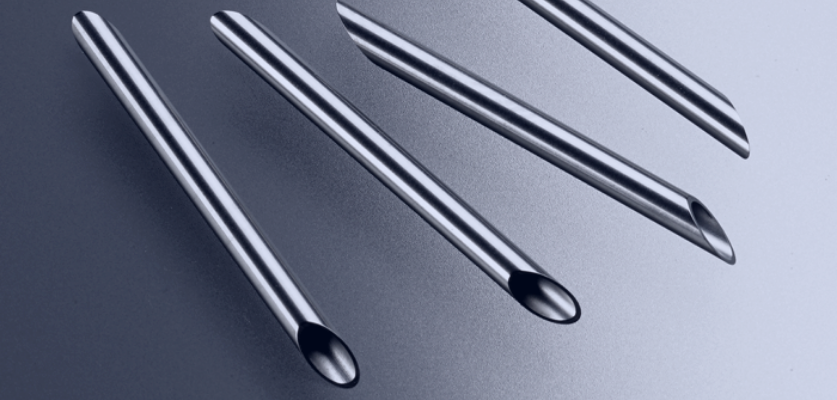

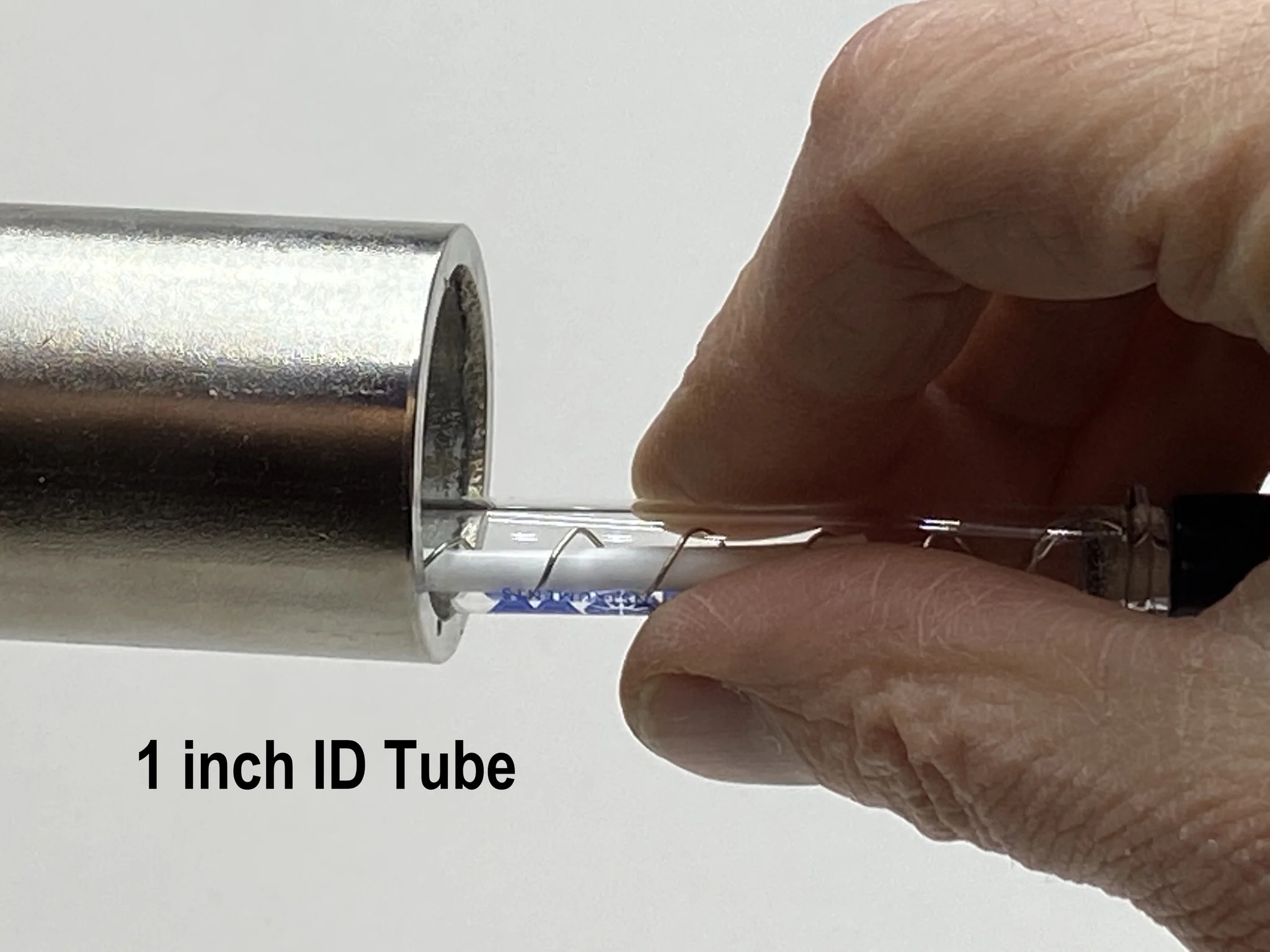

- Hydrogen-ready seamless stainless steel tubes with ultra-clean inner surfaces

- Pickled and passivated piping systems to reduce scaling and corrosion

- Custom heat exchanger bundles engineered to handle thermal cycling

- Low-carbon and traceable material certificates (EN 10204 3.1 / 3.2)

For instance, the Neom Green Hydrogen Project in Saudi Arabia—a $8.4 billion investment—specifically requires materials compatible with hydrogen production and storage, including nickel-alloy heat exchanger tubes and duplex stainless steel for cooling systems.

2. Procurement Shifts from Price-Based to Compliance-Based Models

Historically, procurement in the Gulf Cooperation Council (GCC) markets focused on low price. But this is no longer sufficient. In 2025, EPC contractors, state-owned companies, and industrial end-users are shifting priorities toward:

- Stringent material documentation with full traceability

- Certifications like ASME B31.3, PED, ISO 9001, and ISO 14001

- Sustainability credentials such as Environmental Product Declarations (EPD) or third-party carbon footprint analysis

- Readiness for third-party inspection (TPI) from SGS, TUV, or BV

Stainless steel tube suppliers that cannot provide complete technical files—including mill test certificates (MTC), PMI test results, and hydrostatic pressure reports—are quickly being disqualified.

3. Strategic Pipe Sourcing from China: Still a Viable Choice?

Despite rising freight costs and geopolitical tensions, China remains a preferred source for precision stainless steel tubes and heat exchanger components, thanks to:

- Mature production ecosystem with alloy melting, extrusion, cold drawing, heat treatment, and NDT in-house

- Automated polishing, laser marking, and eddy current testing for quality assurance

- Ability to meet small-batch customization with flexible MOQ

- Competitive pricing backed by volume scalability

For example, companies like DLSS offer ASME SA213 and EN10216-5 certified tubes for condensers, evaporators, and offshore platforms, all with seaworthy packaging and EN 10204-compliant documentation.

4. What Middle East Buyers Expect from Pipe Suppliers in 2025

To remain competitive in the Middle East, pipe manufacturers and traders must align with evolving buyer expectations, including:

| Buyer Requirement | Details |

|---|---|

| Hydrogen compatibility | Smooth inner surface, low sulfur content, non-reactive alloy |

| Certifications | ASME, PED, ISO 14001, CE, EN10204 3.1/3.2 |

| Delivery reliability | Fixed lead times with proactive logistics and tracking |

| Local familiarity | Experience handling customs, documentation, and taxes in UAE, KSA, Oman |

| EPC project coordination | Willingness to attend inspections, support installation drawings |

Frequently Asked Questions (FAQ)

Q1: What certifications are essential for piping systems in Middle Eastern energy projects?

A: ASME B31.3, EN10216-5, PED 2014/68/EU, and ISO 9001 are frequently required. For green projects, ISO 14001 and low-carbon sourcing are becoming key differentiators.

Q2: Are Chinese stainless steel tubes acceptable in large-scale EPC projects?

A: Yes, provided the supplier can offer full technical documentation, meet international standards, and support third-party inspections. Leading Chinese mills now routinely supply products to ADNOC, Aramco, and Petrofac.

Q3: What grades are best for hydrogen and seawater applications?

A: Duplex stainless steel (S31803, S32750) and super austenitic grades (like 904L) offer excellent corrosion resistance in hydrogen-rich or chloride-heavy environments.

Q4: How can pipe suppliers improve their success rate in winning Middle East tenders?

A: By offering fast response times, complete compliance documentation, flexible delivery, and proven success stories with EPC firms in the region.

Conclusion: Compliance Is the New Currency

As the Middle East leads a new wave of clean energy investment, the bar is rising for international suppliers. Whether it’s a desalination plant in Oman, a green ammonia facility in Saudi Arabia, or a solar-powered hydrogen electrolyzer in the UAE—the piping components used must be efficient, certified, and future-proof.

Stainless steel tube and heat exchanger suppliers who focus on traceability, quality, and responsiveness will be the ones shaping the region’s next energy chapter.