India has become one of the fastest-growing hubs for industrial manufacturing, with a focus on energy, infrastructure, and heavy equipment. The Indian government’s flagship initiative—Make in India—coupled with incentives for exports, is rapidly transforming the global stainless steel supply landscape.

For global pipe buyers, EPC contractors, and even competing tube suppliers, this shift brings new opportunities—and challenges.

1. What’s Changing in India?

India is no longer just a buyer of piping systems. It is now a serious producer and exporter of:

- Stainless steel seamless and welded tubes

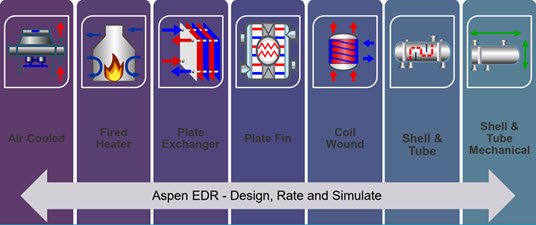

- Finned and U-bent heat exchanger coils

- Boiler tubes, sugar mill condenser tubes, instrumentation pipes

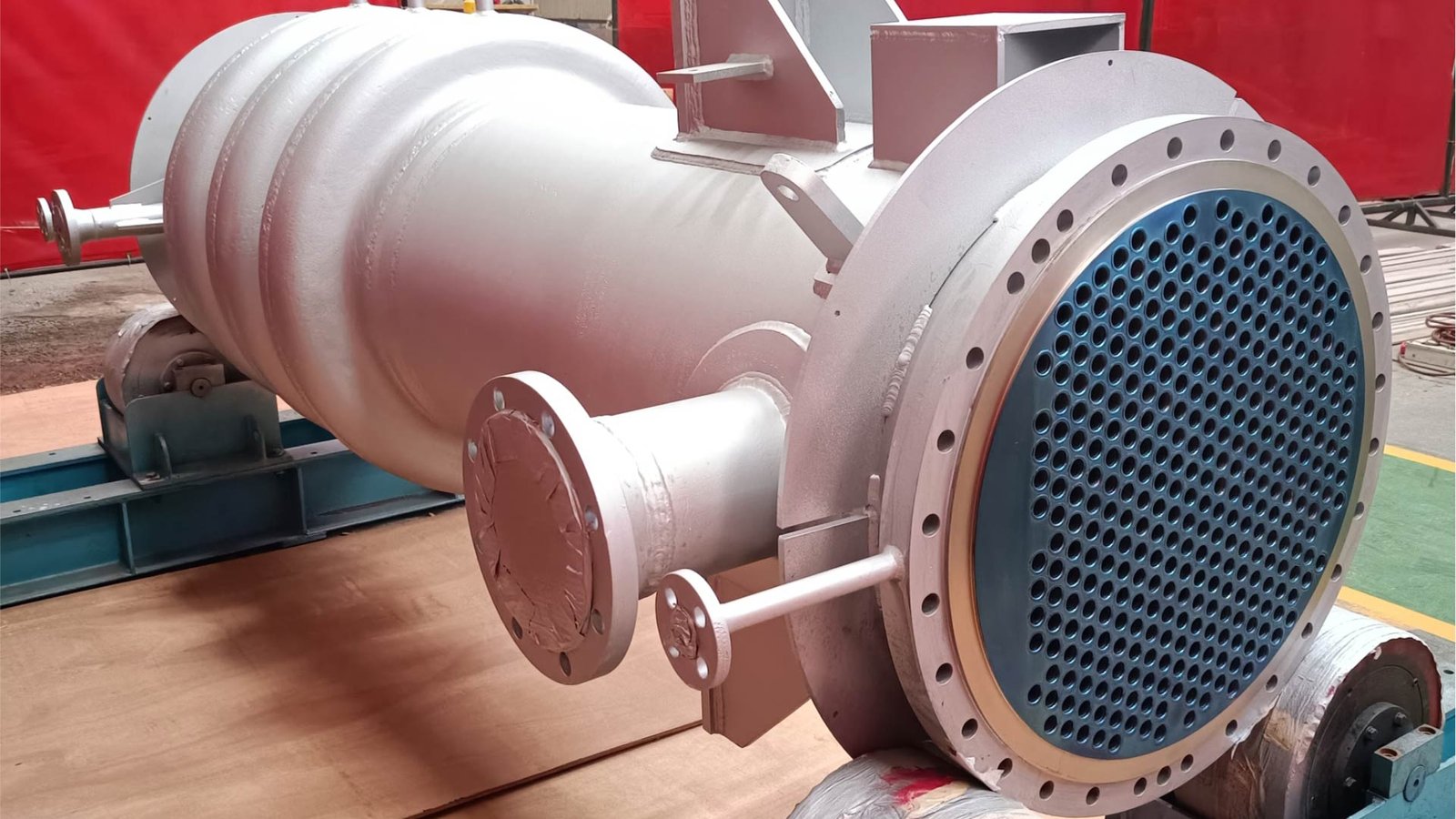

- Complete skid-based heat exchanger systems (under local integration)

Driven by strong domestic demand (e.g., refineries, fertilizers, food processing), and the Production-Linked Incentive (PLI) schemes, India’s manufacturing ecosystem is becoming price-competitive and increasingly standard-compliant.

2. What This Means for Global Buyers

If you’re sourcing stainless steel tubes for use in the Middle East, Africa, or Southeast Asia, you’ve probably noticed that Indian suppliers are now entering tenders that used to be dominated by Chinese or European mills.

| Change | Impact |

|---|---|

| Faster response time | Indian tube exporters are offering 24–48h quotation windows |

| Focus on ASME & PED certification | High-grade projects now consider Indian tubes for SA213/SA312 orders |

| FOB Mumbai or CIF by default | Export-friendly terms and EXIM documentation are improving |

| Low-cost labor + in-house facilities | Boosting cost-performance ratio for boiler, condenser, and finned tubes |

3. Where Indian Tubes Are Gaining Ground

| Region | Application | Reason for Choosing Indian Products |

|---|---|---|

| Middle East | Heat exchangers, power boilers | Low cost, ASME certificate, quick delivery |

| Africa | Process tubes for ethanol, sugar mills | Flexible MOQ, support for TPI |

| Latin America | Refineries, palm oil, food systems | Price-sensitive market, freight advantage over China |

| Southeast Asia | Skid-mounted packaged units | India increasingly supplies integrated systems via EPCs |

Some buyers still express concerns about product consistency, packaging quality, or documentation accuracy, which remain areas for improvement among newer exporters.

4. How Chinese Suppliers Can Stay Competitive

Despite India’s rise, China remains the most complete and scalable stainless steel tube supply base globally. To stay competitive:

- Emphasize technical specialization (e.g., duplex alloys, precision machining)

- Highlight project references and on-time performance

- Offer custom packaging, multi-standard compliance (ASME + EN + JIS)

- Provide multilingual service and stronger customer onboarding

- Focus on value-added content (inspection reports, carbon footprint, traceability)

DLSS, for example, differentiates by offering bright-annealed, pickled, or polished seamless tubes with full 3.1 documentation, short lead time, and tailored export solutions.

Frequently Asked Questions (FAQ)

Q1: Are Indian stainless steel tube suppliers ASME certified?

A: Some mills are, particularly for SA213, SA312, and SA789 tubes. Always verify current certificates and third-party audit status.

Q2: Is Indian packaging and export documentation reliable?

A: Major exporters have improved significantly, but newer or smaller firms may lack consistency. Confirm packing lists, fumigation certificates, and marking formats in advance.

Q3: Are Indian prices lower than Chinese?

A: Often yes, for commodity grades. But in complex alloys or surface-sensitive tubes, Chinese suppliers still hold an edge in consistency and capacity.

Q4: Should global buyers shift entirely to Indian tubes?

A: Not necessarily. A diversified sourcing strategy—combining India for cost-driven projects and China for critical or high-grade applications—is often the best approach.

Conclusion: A Competitive but Collaborative Future

India’s rise in stainless steel tube manufacturing is reshaping sourcing strategies. Buyers now have more regional choices, and suppliers face new benchmarks for quality, price, and speed.

Rather than seeing this as a threat, Chinese and global suppliers can use this as an opportunity to sharpen their value propositions—and maybe even collaborate with Indian EPC firms or integrators on third-country projects.

Because in the new global stainless steel game, success goes not to the lowest bidder—but to the most adaptable partner.